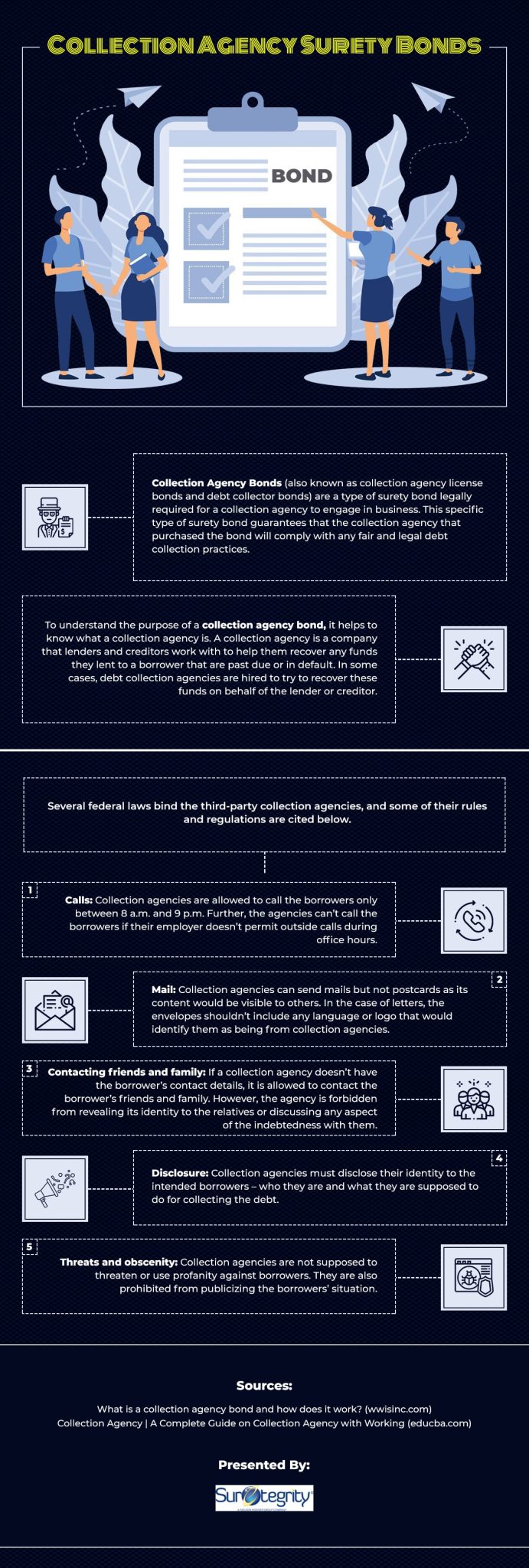

This educational infographic by Suretegrity breaks down the essentials of collection agency surety bonds, making a complex financial topic accessible to business owners, compliance officers, and anyone working in the debt collection industry. Through clear visuals and concise explanations, the infographic explains what a surety bond is, why it's required, and how it protects both consumers and the government.

The infographic begins with a definition of surety bonds, emphasizing their role as a financial guarantee that a collection agency will comply with laws and ethical standards. It outlines the three parties involved: the principal (collection agency), the obligee (government or licensing authority), and the surety (bond provider). Key sections highlight state-specific requirements, the bond amount variations, and how to obtain a bond, including application and underwriting steps.

The infographic also explains what happens if a claim is made against a bond, reinforcing the importance of compliance. With an emphasis on trust, legality, and operational integrity, this infographic serves as a practical resource for collection agencies looking to stay licensed and reputable. It’s particularly useful for new agencies entering the market or those expanding into states with bonding requirements.